Best Travel Credit Cards with No Annual Fee for 2025

- Introduction to Travel Credit Cards

- Why Choose a No Annual Fee Travel Credit Card?

- Top Travel Credit Cards with No Annual Fee

- Maximizing Rewards and Perks

- Real Travel Stories: How These Cards Make a Difference

- Plan Your Next Trip with Rob Travel

Introduction to Travel Credit Cards

Travel credit cards are an excellent way to earn rewards and perks that make your trips more affordable and enjoyable. Whether you are a frequent flyer or just love exploring new destinations, the right travel credit card can offer you valuable benefits such as flight miles, hotel discounts, and exclusive access to airport lounges. But one common concern many travelers have is the annual fee attached to these cards. Thankfully, there are several fantastic travel credit cards available in 2025 that come with no annual fee, allowing you to earn rewards without worrying about extra costs.

Why Choose a No Annual Fee Travel Credit Card?

When you're planning your travel budget, every little bit helps. Choosing a travel credit card with no annual fee ensures that you can enjoy all the perks of a travel rewards program without the added cost of maintaining the card each year. These cards are particularly appealing for those who may not travel enough to justify paying an annual fee but still want to accumulate travel rewards. Furthermore, no annual fee cards are perfect for first-time cardholders or individuals just starting their journey into the world of travel rewards.

Some of the most popular benefits of these no annual fee cards include:

- Accrual of miles or points on everyday purchases

- Access to travel-related discounts and promotions

- Flexible redemption options for flights, hotels, and experiences

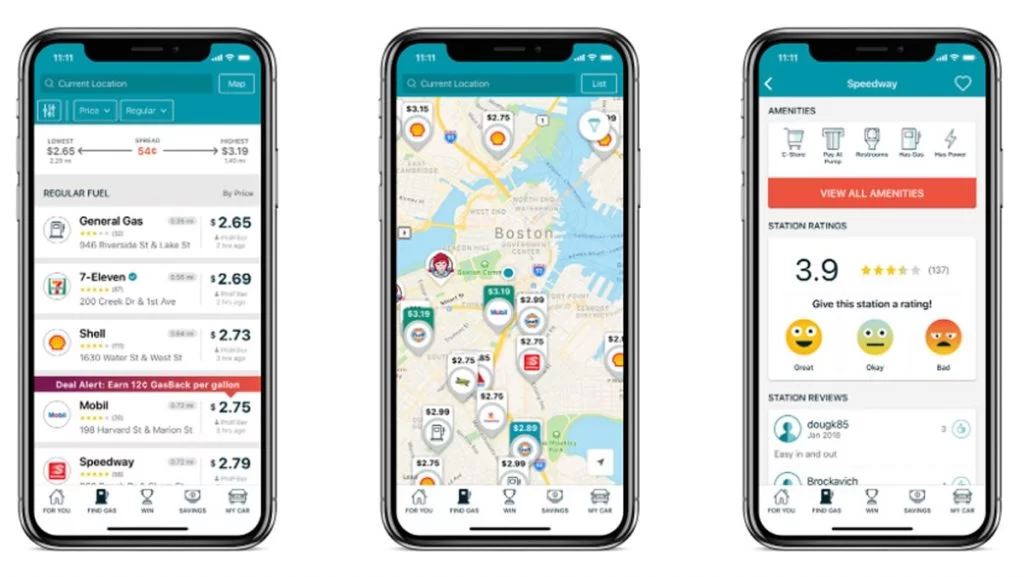

- Easy integration with travel booking apps for seamless planning

Top Travel Credit Cards with No Annual Fee

Here are some of the top-rated travel credit cards for 2025 that offer all the benefits of rewards without the hassle of annual fees:

- Chase Freedom Unlimited® – Great for earning cashback on travel, groceries, and dining. This card also offers 1.5% cashback on all purchases, which can be redeemed for travel rewards through the Chase Ultimate Rewards program.

- Discover it® Miles – Earn unlimited 1.5x miles on every purchase, and your miles will be matched at the end of your first year. Perfect for travelers who want a simple and rewarding way to earn travel rewards.

- Bank of America® Travel Rewards Credit Card – Offers unlimited 1.5 points for every dollar spent on purchases, with no blackout dates or limitations on travel redemption.

- Citi® Double Cash Card – While not specifically a travel card, this card allows you to earn 2% cash back on every purchase, which can be used toward travel expenses or transferred to travel partners for better rewards.

Maximizing Rewards and Perks

While having a no annual fee travel credit card is a great start, understanding how to make the most of its rewards is key to enhancing your travel experience. Here are some tips on how to maximize your rewards:

- Use the Card for Daily Expenses: To rack up points or miles, use your card for everyday purchases such as groceries, gas, and dining. Many cards offer higher rewards for specific categories like dining or travel.

- Redeem Points for Travel: Most travel cards allow you to redeem points or miles for flights, hotels, car rentals, and experiences. Take advantage of these redemptions to make your travel more affordable.

- Sign-Up Bonuses: Many no-fee travel credit cards offer attractive sign-up bonuses. Make sure you meet the spending requirements to earn these bonuses early in your cardholder experience.

Real Travel Stories: How These Cards Make a Difference

Many travelers have shared their personal stories about how a no annual fee credit card helped them make the most of their travels. One user, Emily from Texas, used her Chase Freedom Unlimited® card to accumulate points for a free round-trip flight to Hawaii. She explained, "I didn’t expect to rack up enough points for a free flight, but after a year of using my card for everyday expenses, I was able to book my trip to Hawaii without any extra cost!"

Another frequent traveler, Mark from Florida, found that using his Discover it® Miles card helped him save significantly on hotel bookings for a European tour. He stated, "The ability to earn miles on every purchase really adds up, and the first-year match doubled my rewards, making my European trip much more affordable!"

Plan Your Next Trip with Rob Travel

If you're ready to explore new destinations and take full advantage of your travel rewards, Rob Travel can help you plan your dream trip. With tailored travel services, you can get expert advice, exclusive offers, and easy booking for unforgettable experiences around the globe. Visit Rob Travel for more information and to book your next adventure.